China-Africa energy cooperation is evolving from construction-focused initiatives to a more integrated phase encompassing build, invest, and operate models. Against this backdrop, Kortrong's 32MW solar-storage-diesel multi-energy complementary smart microgrid project in the Democratic Republic of Congo (DRC), deployed under an "EPC+F+O" framework, mirrors this emerging trend and introduces mode innovation—delivering a stable, credible paradigm for advancing novel energy partnerships in the region.

01 Why Power Has Become Mining's Make-or-Break Factor?

In African mining, electricity has shifted from a mere cost line item to a core risk determining profitability and survival. Data indicate electricity costs can account for up to 30% of total mine operating expenses, while fragile supply forces prolonged reliance on diesel generation, at multiples of grid tariffs, with annual fuel consumption running into hundreds of millions to tens of millions of dollars.

Traditional diesel generators generate substantial noise and exhaust emissions, sparking protests from nearby communities; supply chains for fuel transport remain vulnerable to disruptions, any of which can trigger immediate production halts.

This creates a pervasive power dilemma: unaffordable yet unreliable. Conventional single-source models have failed comprehensively on cost, stability, and sustainability fronts, making the pivot to renewables a clear industry consensus.

Yet deployment often encounters three major concerns from decision-makers: technical reliability, sensitive equipment vulnerable to voltage fluctuations that can cause shutdowns; high upfront capital and extended payback periods; and localization hurdles stemming from African supply chains, logistics, and talent constraints.

The market thus demands a deep partner capable of systematically addressing technical challenges, financing structures, and long-term operations.

02 Multi-Energy Complementary Smart Microgrid Reshapes the Energy Foundation

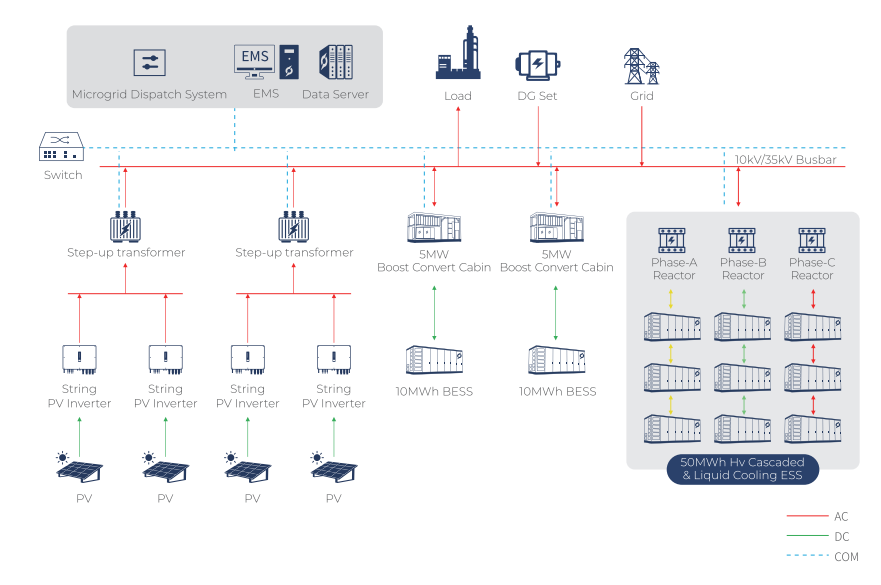

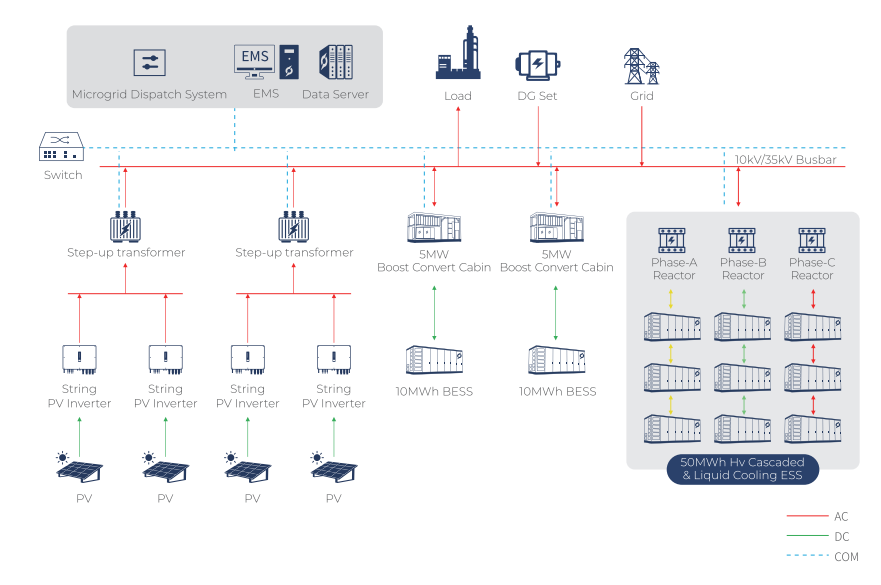

In the DRC, Kortrong Group has deployed a 32MWp solar plant + 25MW/50MWh grid-forming energy storage station + multi-source complementary microgrid control system for local mining zones under an EPC+F+O model, with solar-storage-diesel synergy and active grid-forming at its core.

The solution is projected to deliver 20%-50% reductions in overall electricity costs for mining operations while cutting carbon emissions by up to 90%.

Grid-forming energy storage serves as the cornerstone, actively establishing and maintaining stable voltage and frequency with millisecond-level regulation and black-start capability, fundamentally decoupling from unstable main grids and robustly enabling microgrid black starts.

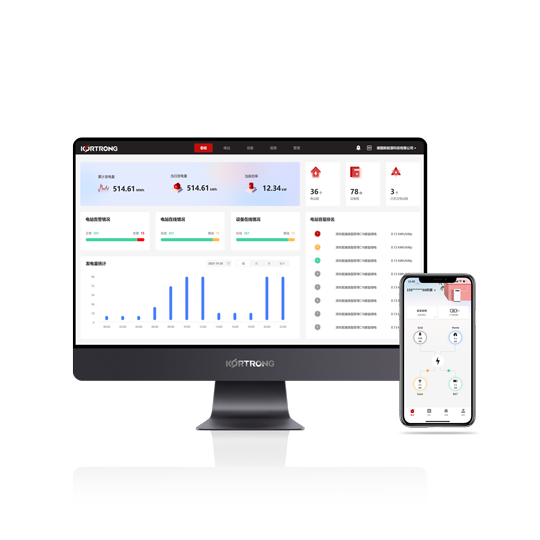

Built atop this foundation, the multi-energy complementary intelligent control system delivers fine-grained smart dispatch via a three-layer, two-network architecture encompassing grid-forming control, coordinated stability control, and energy optimization scheduling.

The system prioritizes maximum photovoltaic utilization, with storage balancing fluctuations in real time to achieve stable daily power output for an average of 8 hours. Diesel generators shift to on-demand "cold standby" activation. Load-shedding by priority automatically ensures uninterrupted supply to critical production and livelihood loads.

03 The Capability Triangle Forges a Moat for Mining Energy Assets

Kortrong's DRC execution hinges on a capability triangle of core proprietary technology, deep industrial synergy, and localized closed-loop operations, forming composite barriers to the model.

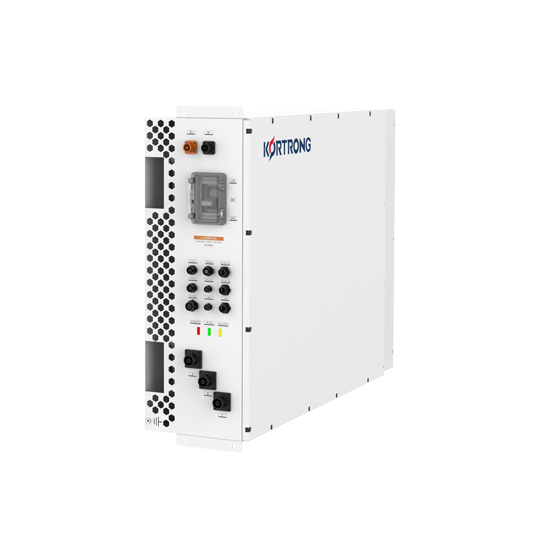

First, core technology secures the asset safety foundation. The 5MWh plate-exchange liquid cooling battery system employed here uses liquid cooling temperature control to maintain differentials ≤4℃, boosting cycle lifespan by 10% while safeguarding operations and significantly extending revenue cycles.

Second, system conversion efficiency of 87%-91%, combined with AI-driven operations, secures full-investment returns of 6%-10%.

Finally, vertical integration enables sustained asset evolution. Through full-chain self-development, Kortrong ensures supply chain security and rapid response while supporting future-proof value retention and upgrades.

By delivering controllable technical foundations, robust asset models, and localized operations, Kortrong evolves from solution provider to strategic asset partner sharing risks and value with clients.

This exemplar is poised to collaborate with more stakeholders, injecting solid power into the world's underserved corners in needs.