Today, independent energy storage is transitioning from a "scale race" to an "operational marathon," with the core of profitability shifting toward market revenues including ancillary services and spot trading. Faced with the reality of rapid hardware expansion and widespread pressure on returns, trading decision-making capabilities based on high-precision forecasting and intelligent algorithms are evolving into the core competitiveness determining the economic viability of power station assets.

01 Systemic Bottlenecks in the Deep Waters of Spot Trading

Against the backdrop of increasingly complex and real-time electricity trading, the traditional operational model of "manual experience + fixed strategies" has become inadequate. This is especially evident in pioneering electricity market trading regions like Shanxi and Inner Mongolia, where high-frequency, multi-sequence market decisions expose systemic operational bottlenecks.

On one hand, decision efficiency and strategy synergy. Between multiple markets like ancillary frequency regulation services and spot arbitrage, there is a lack of intelligent dynamic resource allocation strategies. This inability to precisely quantify real-time opportunity costs results in implicit waste of energy storage capacity potential.

On the other hand, revenue certainty. Stringent technical performance assessments (e.g., performance indicator K value = response time K1 * action rate K2 * response accuracy K3) are tightly linked to economic penalties (e.g., a single reverse regulation in primary frequency regulation ancillary service deducts 0.5% of that day's earnings). This directly ties operational deviations of the entire station to its revenue foundation, posing a sustained challenge to project economics.

02 Core Reconstruction: Intelligent Gaming in Multi-Market Coupling

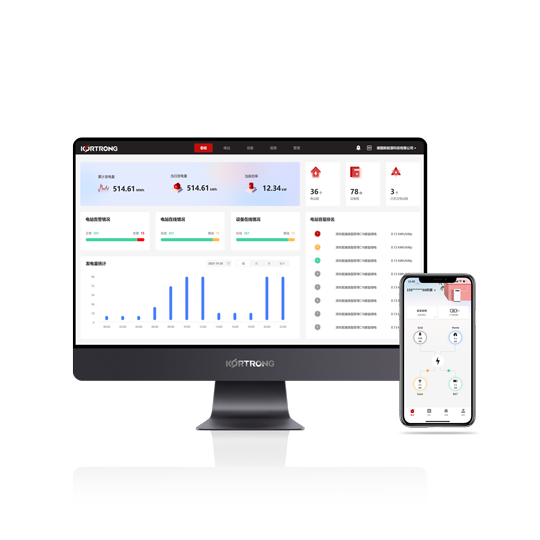

To systematically address market complexity, Kortrong has developed a self-developed AI Intelligent Bidding Decision Support System centered on a "multi-market coupling optimization model." By jointly analyzing day-ahead and historical market transaction data, it maximizes the overall revenue of the power station.

One of its core values lies in actively identifies price differentials across different markets and time periods, constructing revenue models based on virtual deviations. The AI intelligently generates optimal trading strategy portfolios that couple multiple tactics.

One of its core values lies in actively identifies price differentials across different markets and time periods, constructing revenue models based on virtual deviations. The AI intelligently generates optimal trading strategy portfolios that couple multiple tactics.

Another advantage is that the model quantifies the physical degradation cost of the battery as an economic constraint, coupling it with financial rules across time sequences. This ensures the pursuit of energy revenue while still safeguarding the long-term health of the asset.

Aiming to maximize the power station's full-cycle revenue, the system dynamically optimizes the allocation of battery power across multiple markets like frequency regulation and spot trading, achieving comprehensive resource synergy and unleashing the asset's revenue potential.

03 AI Empowerment, Safeguarding Long-Term Asset Value

The "coupling optimization" methodology underpinning the entire solution is a mature approach already validated in fields like integrated energy systems. It seeks global optimal solutions in complex systems by synergizing multiple variables and constraints.

This solution innovatively applies this methodology, combined with AI intelligent tuning, to the refined operation of independent energy storage stations. This drives their evolution from traditional "strategy execution" to "asset operation" based on dynamic value models.

This makes "full lifecycle revenue maximization" no longer just a theoretical concept, but a dynamic process driven by models, data, and algorithms—one that is quantifiable, optimizable, and executable. It provides an intelligent engine for locking in long-term optimal asset value.